- Imagine the loan systems: If you’re USDA finance are a good selection for specific consumers, you should know any alternatives, eg Va fund or FHA loans.

- Collect documents: When you fill in your USDA loan application, you are expected to fill in some documents like pay stubs, taxation statements, and house and you will liability comments. The applying techniques goes more smoothly if you’ve gathered this type of documents ahead of time.

Applying for a great USDA Loan

USDA loans have novel qualification and you can acceptance conditions, and it’s really crucial that you learn how to make an application for one securely. Why don’t we feedback for each trick action of your own procedure.

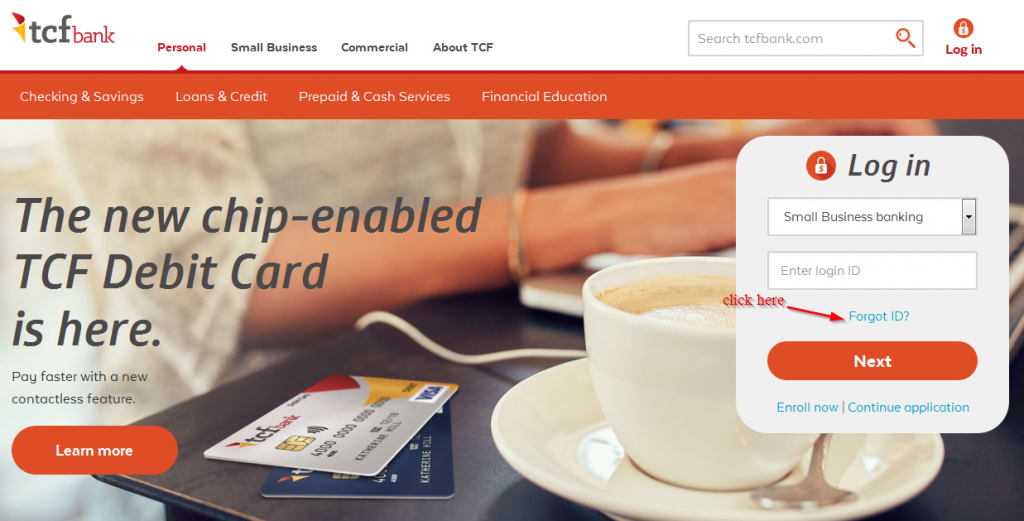

Find an excellent USDA Financial

To locate a USDA mortgage, you ought to work on a medication financial. Really loan providers number on their websites whether they promote USDA finance. The Agencies off Agriculture along with keeps a summary of loan providers you to definitely currently offer these types of money. If you’re during the an outlying city and you may learn other people who have tried USDA money, a word-of-throat recommendation would-be a great 1st step to thin your a number of potential loan providers.

Get Pre-Acknowledged getting an excellent USDA Loan

Pre-acceptance is a vital help to buy a house for all the particular mortgage. Lenders test your finances and see whether you are entitled to a beneficial loan, as well as the amount borrowed and rate of interest you could qualify for. Pre-recognition may also generate suppliers very likely to accept their render.

Get a hold of a beneficial USDA-Approved Trang chủ

To locate a good USDA loan, the home you happen to be to buy need certainly to see the needs. Very first, our home have to be based in an eligible rural area. You can utilize brand new chart available with new Agency out of Farming discover eligible areas near you.

Belongings financed with an effective USDA mortgage must meet certain quality conditions. With respect to the USDA, your house need to be very good, secure, and you will hygienic. Like many fund, USDA finance want an appraisal to be sure the cost was suitable, considering the home’s worthy of.

A purchase contract is actually a contract ranging from good house’s visitors and vendor describing the fresh terms of the acquisition. Ahead of the USDA bank will start the borrowed funds approval techniques, you will have to enter a purchase contract having a vendor and gives the information towards the financial. The financial institution will demand facts about the home together with assented-on price.

Begin the new Underwriting Techniques

Financial underwriting is the process in which a loan provider product reviews the financial advice to make certain you happen to be entitled to that loan. Its you’ll need for most of the home loan applications, as well as to own USDA funds. In the underwriting processes, your own financial usually be certain that details about the a career, money, and you may credit rating to determine your almost certainly capability to pay.

The mortgage financial will be certain that factual statements about the home. Very first, you will need to experience an assessment to discover the home’s really americash loans Coal Creek worth. Concurrently, for a great USDA loan, the lending company will also guarantee the residence is during the an eligible rural town and you will meets the new Institution from Agriculture’s assets criteria.

Your own bank will get ask you to promote more info from the underwriting techniques. The more responsive youre and the quicker you could potentially deliver the questioned guidance, the greater quickly the loan could well be approved.

When your USDA lender enjoys done the fresh underwriting procedure, you’ll receive a final approval and will be removed to shut on the home.

Brand new closure ‘s the last step in your house-to order procedure. Its when owning a home are moved regarding the provider into the visitors. It’s also when you indication your final USDA financing documents.

Of the closing on the loan, you may be stepping into a good contractual arrangement with your financial, encouraging to settle the brand new borrowed count.