Settling debt can feel such as for example a challenging difficulties, but with a health-related procedure in position therefore the correct equipment at your disposal, you could be free of loans sooner than you expect-despite a low income.

In case your money provides suffered recently, otherwise your money isn’t stretching how it familiar with since rates try ascending, you can still reduce the full time it needs to repay the debt.

step 1, Evaluate the money you owe

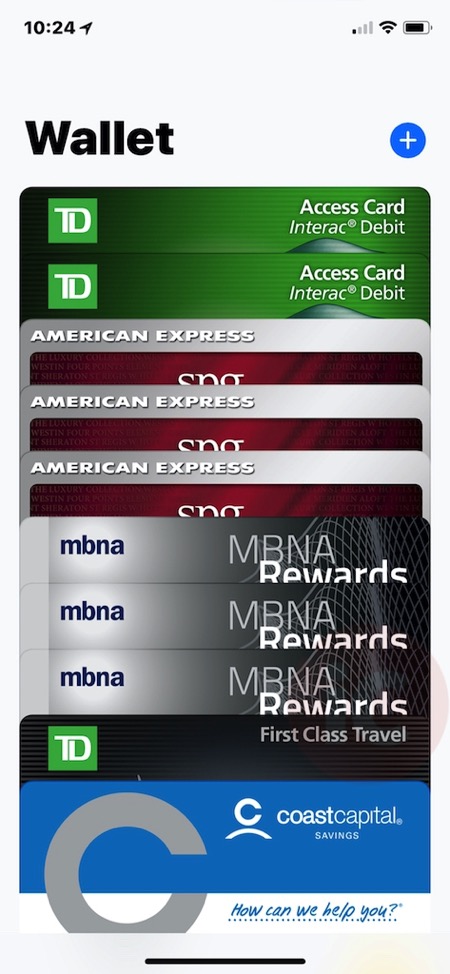

First, get the full image of your debts. Collect all of your economic comments (playing cards, auto loan, etc.) and make an email list to the following situations:

- How much you owe to the funds, large debts (i.e., medical), and you may handmade cards

- The level of interest you are spending

- The apr

- Your lowest monthly installments

Once you know this new extent of your personal debt, you might set certain reachable wants. Such, you might really works towards the diminishing the debt and you can preserving significantly more to possess senior years within this a couple of years.

2. See more money in your budget

Either radical decrease come into purchase, at least for some time. The goal is to cut back on one recommended costs-such as for instance dinner, streaming subscriptions, response expenditures, and maybe car possession.

First, create a detailed finances and you will agree to tracking that which you purchase, in order to come across simply how much you have to pay first expenses. Lifestyle within your means is essential, and it is much easier to carry out once you know precisely where your money is certian.

The main try in search of a technique you might stick with, states Matt Lattman, vice president away from Find Unsecured loans. Due to the fact viewing proceeded progress and just to make sure that you might be reviewing your situation every day is best warranty i keeps with the with the intention that you’re on the road with the economic health.

Sau, contemplate automating your money. Instance, instantly arranged expenses money and lead dumps from your company to your a savings account are click to read fantastic an approach to remain on greatest from debt goals. Perhaps not seeing as money into your savings account will make it simple to avoid using they into other things, there might even become a bank account that can shell out your much more when you look at the attract than simply you are getting today.

However, producing additional money, and you can increasing your obligations money could help, also. In the event that an area work actually in the notes, you are capable earn more income from the offering items you no longer require, sometimes online otherwise during the a storage selling. When you yourself have something you are ready to part with, and you’re offered to write off cost, you might come into some cash instead of too much effort.

3. Keep paying down the debt

Any funds you might squeeze out of your finances might be lay towards your debt. When you yourself have credit card debt, shell out at the least minimal commission towards any stability. And you may whenever you pays over the minimum, do it. You are able to slow down the total number you pay into the focus.

The goal, however, is to try to prevent carrying any revolving personal credit card debt. If you can pay-off your mastercard harmony entirely every month till the deadline, you can end attention charges and you may punishment.

At the same time, make sure to avoid lost money, which will damage their borrowing and you can cause you to incur a lot more personal debt.

4. Hold on your own responsible

You’ll be able to reduce loans much faster for many who make sure to hold yourself responsible for your debt money. It assists setting real deadlines and payment quantity, or you might find yourself neglecting on the subject while they are inconvenient.

Since you remember more personal debt management procedures, the initial and more than main point here to-do is actually sit-down and also make an idea, claims Lattman.

A personal bank loan shall be a useful equipment inside esteem, since it have a predetermined title which have put monthly premiums. You will know exactly when you are able to repay the borrowed funds for people who generate all of your money punctually. And you can, based the loan payment identity as well as how far you pay over the minimum commission on your financing and just about every other debt, a personal bank loan could help lower your debt burden sooner or later.

5. Discuss having creditors

When you are dealing with a difficult time, providers (cellular telephone business, tools, etc.) might possibly be willing to offer rentals, such as for example lowering your money otherwise extending the commission terms and conditions. Therefore, do not be scared to inquire about.

When you’re in a position to work-out an option bundle, query for every piece of information in writing to make sure your know very well what youre agreeing to help you. And make sure that you do not miss one costs.

6. Consider different procedures and you can systems to own repaying obligations:

- A personal loan to have debt consolidation reduction you will definitely will let you consolidate your debt and you may pay back financial institutions truly. Then you can pay the mortgage having a fixed payment and you will interest.

- Debt relief happens when a 3rd-group organization steps in and you can negotiates money together with your borrowing credit businesses. Just be sure to research the debt relief organization, know what the liberties are given that a buyers, and you may learn about the potential impression for the credit score.

- A property collateral mortgage may come having a lowered rates than simply you happen to be purchasing to the a premier-interest charge card harmony, nonetheless it need placing your residence right up while the security in order to safe the borrowed funds. As property guarantee financing or cash-away refinancing are used for large quantity, they could be good choices while you are as well as carrying out an enormous project including a property inclusion.

- Good 401(k) mortgage. Specific employers will allow you to borrow cash from your 401(k) later years bundle. Be sure to consider the huge benefits and cons out-of your own financing rather than a good 401(k) financing. There may be drawbacks such lost increases otherwise shedding a manager match.

- Correspond with a cards therapist, that will evaluate your debts, make it easier to talk about debt consolidating if you’re underemployed, or suggest an effective way to pay off debt prompt which have a minimal income. The initial talk is free, so that you have absolutely nothing to shed away from a primary meeting.

- Commemorate their achievements. Paying off obligations is difficult, and each pass action counts. Award on your own once you hit a good milestone, ing flick binge.

eight. Do not do it by yourself

It could be hard to talk openly throughout the circumstances pertaining to currency, it will help tap a good friend or family unit members associate to be the responsibility mate in your debt benefits plan. They could help you follow through so much more continuously that will also end up being a way to obtain moral support.

Therefore, build your debt relief a residential area work. And remember so you’re able to celebrate because you achieve your goals-a stroll otherwise coffee along with your accountability partner would be merely the latest support you will want to proceed to your following financial objective.

With the help of our debt consolidation calculator, you will find the possibility discounts away from merging high attention debt having a loan away from Get a hold of. Estimate Deals