We recommend an informed situations thanks to a separate remark procedure, and you may business owners dont determine our very own selections. We could possibly discovered compensation for those who visit couples i encourage. Comprehend our advertiser disclosure to find out more.

Western Knowledge Services (AES) are a federal financing servicer you to process FFEL funds. As FFEL system was left behind, AES however handles consumers during the costs, and it also characteristics some private student education loans to many other loan providers. Because the good servicer, AES has been the mark of a few complaints and you may case, but your choices are minimal if you’re unhappy with your servicer.

- Secret Takeaways

- Business Analysis

- AES is that loan servicer having federal FFEL financing and some individual student education loans

- AES is belonging to the Pennsylvania Advanced schooling Direction Agency (PHEAA)

- AES and you can PHEAA commonly authorities companies; he’s personal organizations

- For the , AES’ mother business PHEAA paid a category-step suit stating the latest PHEAA purposely did to extend the exact distance regarding borrowers’ cost terms and conditions

- In the event the AES can be your servicer, the only method to switch loan servicers would be to re-finance otherwise consolidate their funds

- 12 months Founded 1963

- Certified Site

Western Training Services (AES) try a student loan servicer for Federal Household members Student loan (FFEL) program money. FFEL funds become Stafford Money, Unsubsidized Stafford Fund, Federal Along with Loans, and Government Integration Financing. New FFEL system try discontinued during the , but given that their financing are nevertheless into the cost, millions of individuals have AES as his or her loan servicer.

What exactly is Western Studies Services?

AES try owned by the fresh Pennsylvania Higher education Assistance Agency (PHEAA) and you may try built to solution and guarantee FFEL and lots of alternative private student education loans. A student-based loan servicer doesn’t give finance; simple fact is that middleman between the debtor plus the student loan lender into the repayment period. AES along with claims the fresh new loans, meaning it agrees to settle the debt if the borrower standard.

New fund that AES characteristics could be possibly personal student education loans otherwise government college loans lent through the FFEL program, nonetheless they won’t be whatever financing apart from FFEL. AES may not be the servicer for folks who took out your financing adopting the FFEL system was discontinued to your .

In case the government loans had been applied for immediately following , they might remain serviced by the AES’s father or mother organization, PHEAA, just like the FedLoan Repair.

While being unsure of if AES is actually otherwise are your loan servicer, you could sign into your federal beginner aid Membership Dashboard or check your credit history to find out if AES try listed.

Is actually AES a national Company?

The newest Pennsylvania Degree Assistance Agencies are an excellent quasi-nongovernmental business. It was based due to the fact an effective Pennsylvania county company it is today work on in person, which have restricted legislative supervision with its panel off administrators.

Try AES a national Student loan?

When you are PHEAA even offers personal student education loans called PA Forward financing, you will not discover federal or individual AES loans. FFEL was a program one let individual lenders to add federally secured figuratively speaking and you may greeting the federal government so you’re able to mandate specific desire rate account for those financing. Thus, rather than financing, AES guarantees and services the individuals lenders’ FFEL finance.

Repaying their college loans: You could potentially put up autopay, create earnings-passionate fees, alter commission needs, circulate the due date, and you may pay ahead.

Obtaining financial hardship programs: You could get deferment and you can forbearance, quicker costs, putting-off repayments, and you will government financing consolidation.

Loan forgiveness: You will see for individuals who qualify for financing launch, professor financing forgiveness, the general public Service Financing Forgiveness (PSLF) program, and you can people professionals to have service members.

Since your financing servicer, AES are whom you go to if you’re unable to afford the payments, have to button payment plans, otherwise features questions relating to your bank account.

Learning to make Western Studies Qualities Money

You’ll be able to shell out from AES mobile app, of the mobile phone at step one-800-233-0557, otherwise from the mailing a or money buy payable so you’re able to American Education Features in order to:

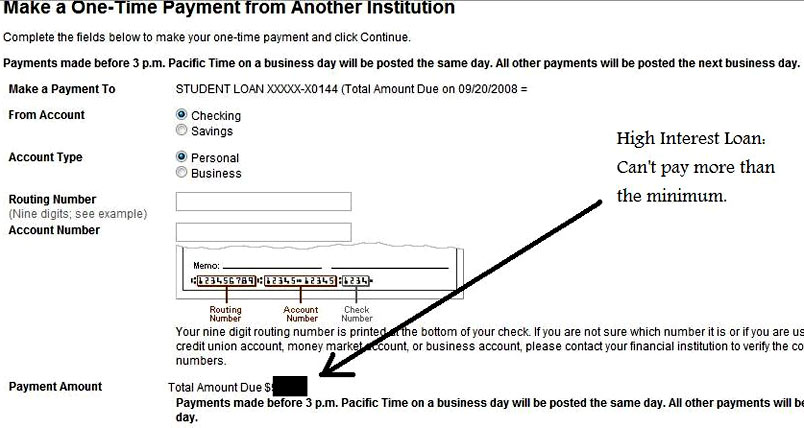

Lead Debit is the easiest method in making repayments in order to AES. Lead Debit creates an electronic deduction from your own checking or family savings in your deadline each month, ensuring that your instalments are on time, provided you’ll find adequate fund throughout the membership.

In the Western Training Properties

You could potentially get in touch with AES by delivering a safe email address from the inside your bank account otherwise by the phone within step 1-800-233-0557, Tuesday due to Tuesday, 7:29 an effective payday loans fast cash.yards. so you’re able to nine:00 p.meters. Ainsi que. You could send characters to help you:

There have been twenty four issues submitted to the consumer Economic Safety Bureau in 2020 from the AES. The obtained a timely impulse, and most was indeed signed having a conclusion-a couple of lead to financial relief from the firm, and two produced low-financial save. Many narratives quoted disappointment toward business’s responsiveness to help you customers points otherwise insufficient flexible installment possibilities since number 1 condition.

American Studies Features Suit

PHEAA could have been at the mercy of several litigation by the claims to possess presumably mistreating and mistreating borrowers from the PSLF program. Into the , the mortgage servicer paid a class-step lawsuit introduced forth because of the Massachusetts attorneys general you to said PHEAA intentionally spent some time working to give the duration of individuals financing, translated offers to the loans, and you may don’t securely update people of PSLF program’s conditions, resulting in an about 99% denial rates.

Are American Education Characteristics Your own Only Servicer?

When you yourself have FFEL money, AES isnt the just financing-upkeep choice. If you wish to disperse your money to a different servicer, you really have a number of options.

Re-finance Their Financing

Refinancing your own figuratively speaking as a result of a personal financial can potentially rating you a lowered interest, reduce your monthly payment, which help you pay away from the money very early. Additionally alter the loan servicer. Investopedia keeps analyzed all of the greatest student loan re-finance people to help you find the correct complement your.

Combine The Loans

Once you combine your government loans to the one the brand new government direct loan, you might favor an alternative servicer. Keep in mind that combining fund you will help the adjusted average of your own earlier in the day rates of interest from the 0.125%.

Subscribe Public-service Financing Forgiveness

When you join PSLF, their money is automatically gone to live in FedLoan Maintenance. Observe that when you find yourself functioning under an alternate identity, FedLoan Repair is still PHEAA.

When it comes to your loan servicer, you do not get to choose the person you manage; your loan servicer is assigned to your. If you find yourself let down on the provider you’ve gotten away from AES, think refinancing your own student loans otherwise combining your financing having good Direct Combination Loan to acquire other servicer.

Methodology

Investopedia was serious about getting people that have objective, complete product reviews out of education loan lenders. We compiled over 45 investigation facts round the over fifteen loan providers-and additionally rates, charge, loan amounts, and you will payment terms and conditions-so that our very own content assists pages improve right borrowing from the bank choice due to their education need.